Context

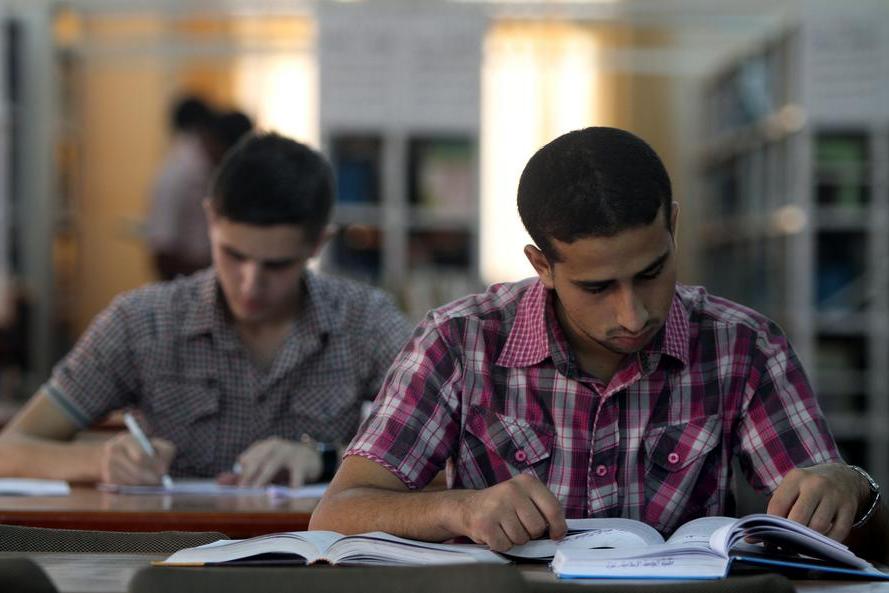

Despite significant progress over the past several decades, achieving universal access to primary, secondary, and technical vocational education in African countries remains a considerable challenge. According to the World Bank, around 50 million children in Africa are out of school, representing 45% of the global out-of-school population (Bashir et al., 2018). The rising demand for quality primary and secondary education puts substantial pressure on public budgets in African countries. Financial constraints on public education systems have led to the growth of the private education sector, which places an additional financial burden on households to bridge the funding gap.

Solution

To address this issue, the Regional Education Finance Fund for Africa (REFFA) was launched in 2012 by KfW and funded by BMZ. REFFA aims to improve access to and the quality of education for low and lower-middle-income households across Africa. It channels funds through local financial intermediaries to education providers, students, and their families.

REFFA provides both debt investments and technical assistance to financial institutions in ODA-eligible African countries. The loans range from US$0.5 million to US$5 million, paid in local currency, with terms of up to seven years. Most loans are long-term, with 87% extended for over 36 months. Eligible financial institutions must be professionally managed, demonstrate good financial performance, and show a strong interest in education.

Additionally, participating financial institutions receive customized technical assistance to enhance their capacity for sustainable education finance lending. This assistance typically includes market analysis, support in designing finance products, strengthening internal processes, and staff training in education finance products.

Impact

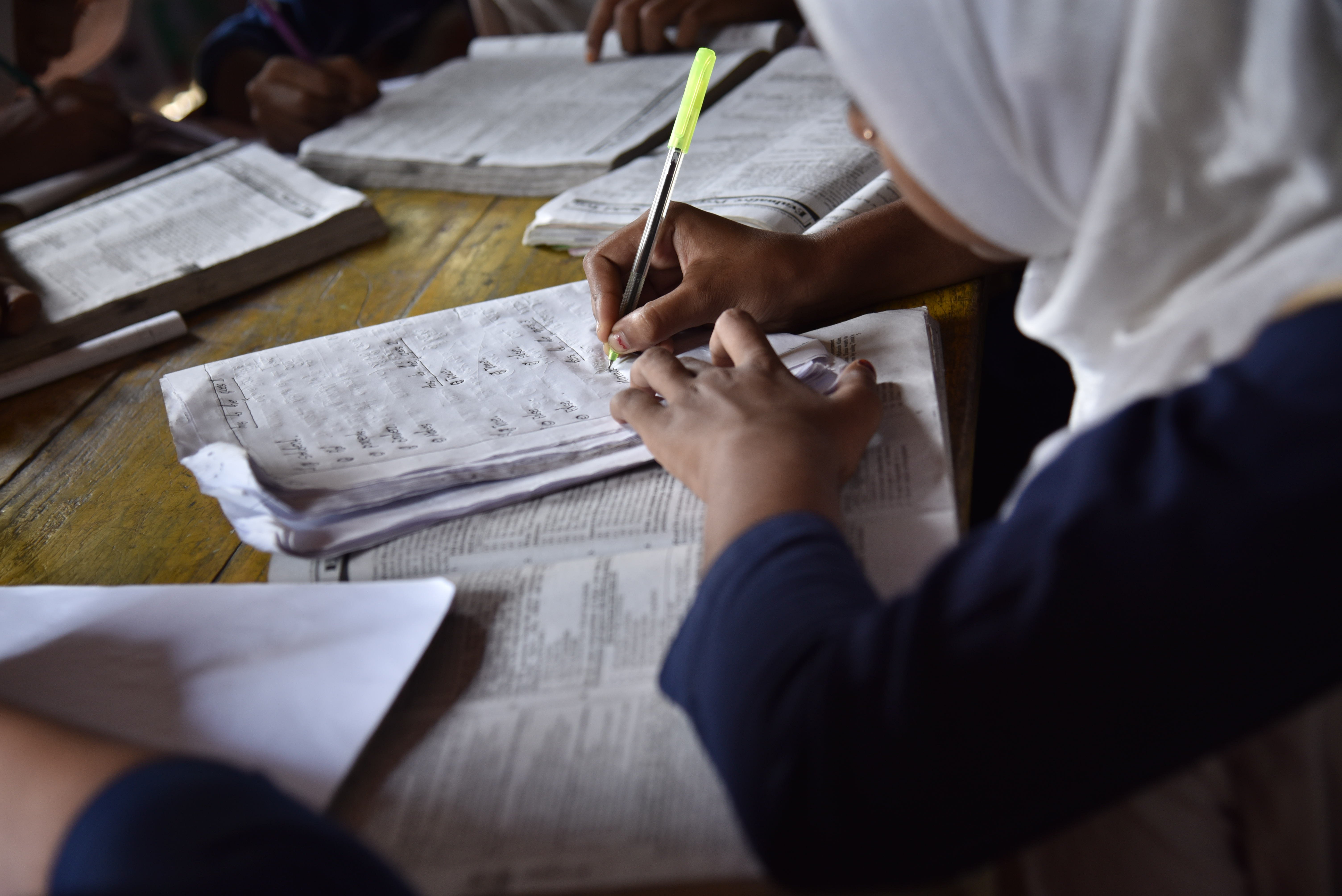

REFFA funds and technical assistance enable financial intermediaries to offer education loans and savings to two primary client groups: private education providers and private households (learners and their families). These households include those with income from micro, small, and medium enterprises (MSMEs) or salary income and students seeking to finance their own education (REFFA, 2021). For many investees, a significant portion of their portfolio consists of MSMEs and loans to low-income individuals. Loans and savings products are tailored to the local market environment.

As of March 2022, REFFA is active in nine countries, serving 2,923 education providers and approximately 125,720 students through its financial intermediaries. Over 30 capacity-building or market research projects have been successfully completed, with an additional 17 underway, through REFFA’s technical assistance component. This initiative represents a significant step in addressing the educational financing gap and enhancing the quality of education for underserved populations in Africa.